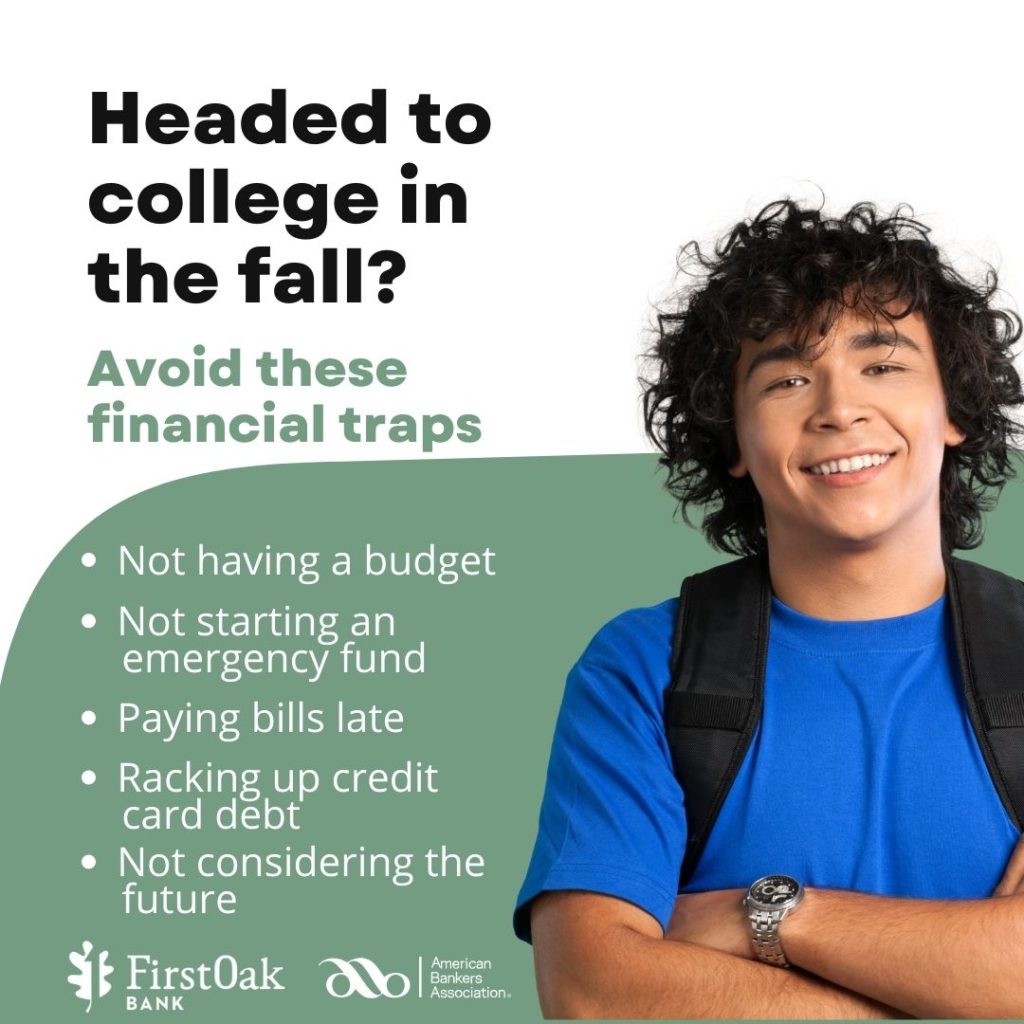

Avoid these financial traps!

Headed to college in the fall? Make your financial stability a priority! The American Bankers Association has identified 6 pitfalls to be aware of to help new students secure their future.

Get a budget!

Don’t spend more than you make. Figure out how much money you can afford to spend each month while contributing to your savings.

Start an emergency fund!

Start saving for an emergency fund. Make it a priority to put away a little bit each month no matter how small the amount. This will help you avoid going into debt when your car breaks down or for an unforeseen medical expense. FirstOak Bank can help you setup a savings account.

Pay your bills each month and on-time!

Missed payments can hurt your credit and can affect your ability to get credit in the future. This can mean credit for a new car, a home, and more. Consider setting up automatic payments

Don’t rack up debt!

Spend only what you can afford to pay back and check with a FirstOak Bank representative for accounts that fit your need and lifestyle.

Think about the future!

It may seem odd to think about your future since you’re just starting your career but thinking about your future now will prevent debt and other financial issues later.

Get help from your bank!

FirstOak Bank offers a number of services and tools to help you manage your finances and keep your budget and emergency fund on track!